News

September 21, 2025

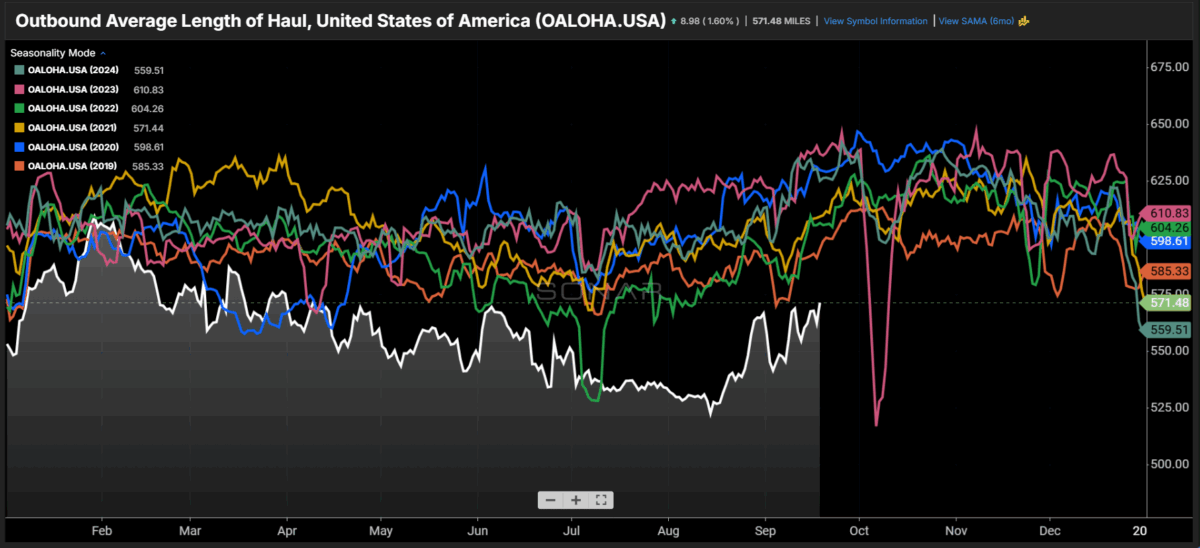

Truckload average length of haul hits new lows

Truckload carriers are not only hauling less freight, but moving it less distance. This has a compounding effect on keeping capacity loose as longer moves take up more capacity. If supply chain strategies normalize, it could have an impact on transportation markets. The post Truckload average length of haul hits new lows appeared first on FreightWaves.

**Truckload Average Length of Haul Hits New Lows, Signaling Shift in Freight Transportation**

The trucking industry is facing a double whammy: less freight to haul and shorter distances to haul it. Recent data indicates that the average length of haul for truckload carriers has reached a new low, signaling a significant shift in the dynamics of the freight transportation market. This trend, coupled with already reduced freight volumes, is creating a ripple effect that could have lasting consequences for capacity and pricing.

Essentially, truckload carriers are moving goods over shorter distances than ever before. While this may seem like a minor detail, it has a considerable impact on overall capacity. Longer hauls naturally tie up trucks and drivers for extended periods, effectively reducing the available capacity in the market. When hauls are shorter, trucks can complete more trips in the same timeframe, keeping capacity relatively loose and readily available.

This situation is largely attributed to current supply chain strategies. Businesses have been adjusting their inventory management and distribution networks in response to fluctuating demand and economic uncertainties. These adjustments often involve regionalizing distribution centers and relying on more frequent, smaller shipments to be closer to their customer base. This translates to shorter distances for truckload carriers.

The implications of this trend are multifaceted. With capacity remaining loose, downward pressure on freight rates is likely to persist. Carriers may find it challenging to secure profitable loads, particularly if they are heavily reliant on long-distance routes. Simultaneously, the increased efficiency driven by shorter hauls could potentially reduce fuel consumption and emissions, offering some environmental benefits.

However, the long-term sustainability of this trend hinges on the normalization of supply chain strategies. If businesses revert to pre-pandemic inventory practices and centralized distribution models, the demand for longer-haul trucking services could rebound. This, in turn, would tighten capacity and potentially lead to a shift in the transportation market.

Industry experts are closely monitoring these developments, emphasizing the need for carriers to adapt their strategies to navigate the evolving landscape. Understanding the factors driving the decline in average length of haul is crucial for making informed decisions regarding fleet management, pricing, and route optimization. The future of truckload transportation may well depend on how effectively carriers respond to this fundamental shift in the market.

The trucking industry is facing a double whammy: less freight to haul and shorter distances to haul it. Recent data indicates that the average length of haul for truckload carriers has reached a new low, signaling a significant shift in the dynamics of the freight transportation market. This trend, coupled with already reduced freight volumes, is creating a ripple effect that could have lasting consequences for capacity and pricing.

Essentially, truckload carriers are moving goods over shorter distances than ever before. While this may seem like a minor detail, it has a considerable impact on overall capacity. Longer hauls naturally tie up trucks and drivers for extended periods, effectively reducing the available capacity in the market. When hauls are shorter, trucks can complete more trips in the same timeframe, keeping capacity relatively loose and readily available.

This situation is largely attributed to current supply chain strategies. Businesses have been adjusting their inventory management and distribution networks in response to fluctuating demand and economic uncertainties. These adjustments often involve regionalizing distribution centers and relying on more frequent, smaller shipments to be closer to their customer base. This translates to shorter distances for truckload carriers.

The implications of this trend are multifaceted. With capacity remaining loose, downward pressure on freight rates is likely to persist. Carriers may find it challenging to secure profitable loads, particularly if they are heavily reliant on long-distance routes. Simultaneously, the increased efficiency driven by shorter hauls could potentially reduce fuel consumption and emissions, offering some environmental benefits.

However, the long-term sustainability of this trend hinges on the normalization of supply chain strategies. If businesses revert to pre-pandemic inventory practices and centralized distribution models, the demand for longer-haul trucking services could rebound. This, in turn, would tighten capacity and potentially lead to a shift in the transportation market.

Industry experts are closely monitoring these developments, emphasizing the need for carriers to adapt their strategies to navigate the evolving landscape. Understanding the factors driving the decline in average length of haul is crucial for making informed decisions regarding fleet management, pricing, and route optimization. The future of truckload transportation may well depend on how effectively carriers respond to this fundamental shift in the market.

Category:

Business