News

November 28, 2025

Opinion: California tax revenue growing from AI boomlet, but will it last?

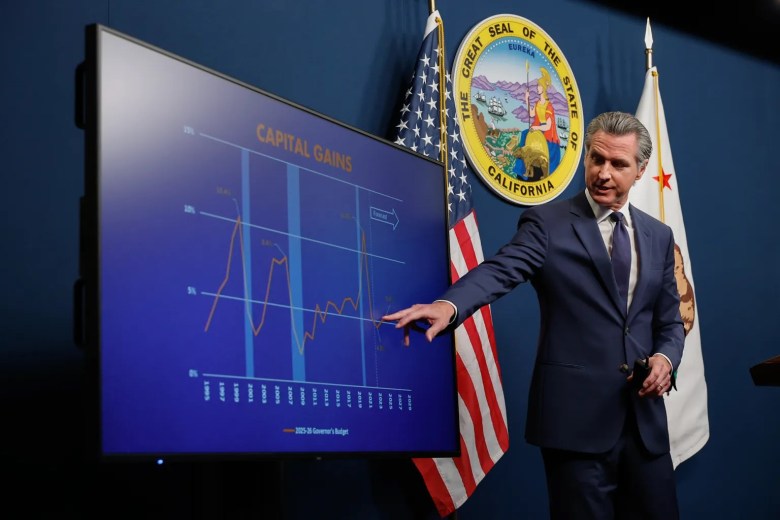

Recent tax revenue gains may be just a spike driven by an artificial intelligence boom in Silicon Valley that’s likely to implode,

California's coffers are looking healthier than expected, but some experts are warning that the good times might not last. A recent surge in tax revenue is being attributed to a boom in artificial intelligence (AI) within Silicon Valley, leading to increased income and capital gains taxes. However, this AI-driven windfall is viewed by some as a temporary spike, rather than a sustainable trend.

The buzz around AI has fueled significant investment and job creation in the Golden State, particularly in the tech hubs surrounding San Francisco. Companies developing AI technologies are attracting massive venture capital, leading to lucrative exits and high salaries for employees. This translates directly into more tax dollars flowing into state government.

But the question on many minds is whether this AI boom is built to last. Concerns are being raised about the speculative nature of the AI market, with some analysts suggesting that current valuations are overinflated. Much like the dot-com bubble of the late 1990s, there's a fear that the AI sector could be prone to a correction, potentially leading to a significant drop in investment and, consequently, tax revenue.

"We're seeing a lot of excitement and investment in AI right now, which is great for the short-term," says a leading economist familiar with California's budget. "But we need to be cautious about relying too heavily on this sector for long-term fiscal stability. History has shown us that these kinds of booms can be followed by busts."

The potential for an AI "implosion" is a serious concern for state policymakers. If the AI market cools down, California could face a sudden drop in tax revenue, potentially leading to budget cuts and other difficult decisions. Therefore, experts are urging caution and advocating for responsible fiscal planning that doesn't rely solely on the continued success of the AI industry. Diversifying the state's economy and exploring other revenue streams are being discussed as potential strategies to mitigate the risks associated with a volatile AI market. The state needs to prepare for the possibility that this recent surge in tax revenue is a fleeting phenomenon, rather than the start of a new era of prosperity.

The buzz around AI has fueled significant investment and job creation in the Golden State, particularly in the tech hubs surrounding San Francisco. Companies developing AI technologies are attracting massive venture capital, leading to lucrative exits and high salaries for employees. This translates directly into more tax dollars flowing into state government.

But the question on many minds is whether this AI boom is built to last. Concerns are being raised about the speculative nature of the AI market, with some analysts suggesting that current valuations are overinflated. Much like the dot-com bubble of the late 1990s, there's a fear that the AI sector could be prone to a correction, potentially leading to a significant drop in investment and, consequently, tax revenue.

"We're seeing a lot of excitement and investment in AI right now, which is great for the short-term," says a leading economist familiar with California's budget. "But we need to be cautious about relying too heavily on this sector for long-term fiscal stability. History has shown us that these kinds of booms can be followed by busts."

The potential for an AI "implosion" is a serious concern for state policymakers. If the AI market cools down, California could face a sudden drop in tax revenue, potentially leading to budget cuts and other difficult decisions. Therefore, experts are urging caution and advocating for responsible fiscal planning that doesn't rely solely on the continued success of the AI industry. Diversifying the state's economy and exploring other revenue streams are being discussed as potential strategies to mitigate the risks associated with a volatile AI market. The state needs to prepare for the possibility that this recent surge in tax revenue is a fleeting phenomenon, rather than the start of a new era of prosperity.

Category:

Technology