News

November 13, 2025

Nigeria Embedded Finance Market Databook (Q4 2025 Update) - Access Over 100 KPIs, Including Transaction Value and Revenue

Dublin, Nov. 12, 2025 (GLOBE NEWSWIRE) -- The "Nigeria Embedded Finance Market Size & Forecast by Value and Volume Across 100+ KPIs by Business Models, Distribution Models, End-Use Sectors, and Key Verticals (Payments, Lending, Insurance, Banking, Wealth) - Databook Q4 2025 Update" has been added to ResearchAndMarkets.com's offering.

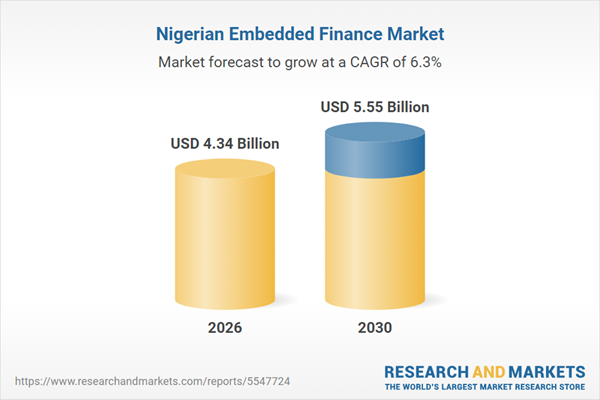

Nigeria's embedded finance market is poised for significant growth, according to a comprehensive new databook released by ResearchAndMarkets.com. The "Nigeria Embedded Finance Market Databook (Q4 2025 Update)" offers an in-depth analysis of the sector, providing access to over 100 Key Performance Indicators (KPIs) crucial for understanding its current state and future trajectory.

Published on November 12, 2025, the databook delves into various aspects of Nigeria's embedded finance landscape, including transaction value and revenue. This data is essential for businesses looking to enter or expand their presence in this rapidly evolving market. Embedded finance, which integrates financial services into non-financial platforms, is transforming how Nigerians access and utilize financial products.

The report provides a granular view of the market, dissecting it by business models, distribution models, and end-use sectors. This detailed segmentation enables stakeholders to identify specific opportunities and tailor their strategies accordingly. It also examines key verticals within the embedded finance ecosystem, including payments, lending, insurance, banking, and wealth management. Each of these sectors is analyzed in terms of value and volume, offering a complete picture of their performance.

For companies operating in sectors like e-commerce, retail, and technology, the databook offers valuable insights into integrating financial services seamlessly into their existing platforms. This integration can enhance customer experience, drive revenue growth, and foster greater financial inclusion across Nigeria.

The Q4 2025 update ensures that the information is current and reflects the latest market trends. By providing forecasts and analyzing historical data, the report equips businesses with the knowledge they need to make informed decisions and capitalize on the burgeoning opportunities within Nigeria's embedded finance market. The databook is a valuable resource for investors, entrepreneurs, and established financial institutions seeking to understand and navigate this dynamic landscape.

Published on November 12, 2025, the databook delves into various aspects of Nigeria's embedded finance landscape, including transaction value and revenue. This data is essential for businesses looking to enter or expand their presence in this rapidly evolving market. Embedded finance, which integrates financial services into non-financial platforms, is transforming how Nigerians access and utilize financial products.

The report provides a granular view of the market, dissecting it by business models, distribution models, and end-use sectors. This detailed segmentation enables stakeholders to identify specific opportunities and tailor their strategies accordingly. It also examines key verticals within the embedded finance ecosystem, including payments, lending, insurance, banking, and wealth management. Each of these sectors is analyzed in terms of value and volume, offering a complete picture of their performance.

For companies operating in sectors like e-commerce, retail, and technology, the databook offers valuable insights into integrating financial services seamlessly into their existing platforms. This integration can enhance customer experience, drive revenue growth, and foster greater financial inclusion across Nigeria.

The Q4 2025 update ensures that the information is current and reflects the latest market trends. By providing forecasts and analyzing historical data, the report equips businesses with the knowledge they need to make informed decisions and capitalize on the burgeoning opportunities within Nigeria's embedded finance market. The databook is a valuable resource for investors, entrepreneurs, and established financial institutions seeking to understand and navigate this dynamic landscape.

Category:

Technology