News

October 21, 2025

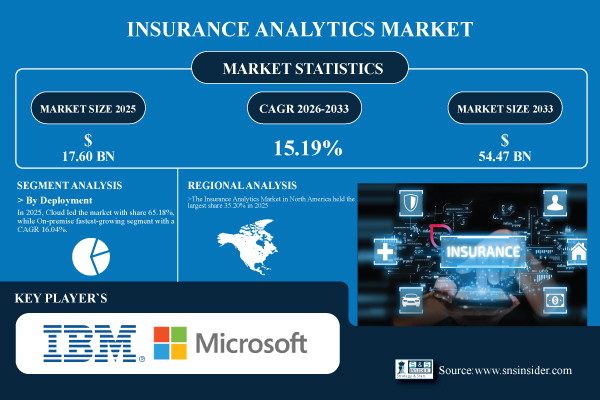

Insurance Analytics Market to Reach USD 54.47 Billion by 2033 Driven by AI and Big Data Integration | SNS Insider

The Insurance Analytics market is growing rapidly as insurers leverage AI, ML, and big data to enhance fraud detection, personalize offerings, and streamline underwriting and claims management for improved operational efficiency. The Insurance Analytics market is growing rapidly as insurers leverage AI, ML, and big data to enhance fraud detection, personalize offerings, and streamline underwriting and claims management for improved operational efficiency.

The insurance industry is undergoing a significant transformation, fueled by the explosive growth of data analytics. According to a new report by SNS Insider, the Insurance Analytics market is projected to reach a staggering USD 54.47 billion by 2033. This dramatic expansion is being driven by the increasing adoption of artificial intelligence (AI), machine learning (ML), and big data technologies within the sector.

Insurers are recognizing the immense potential of these technologies to revolutionize various aspects of their operations. One of the primary drivers is the need for more effective fraud detection. Traditional methods often struggle to keep pace with increasingly sophisticated fraudulent activities. AI and ML algorithms can analyze vast datasets to identify patterns and anomalies that would otherwise go unnoticed, helping insurers to mitigate losses and protect their bottom line.

Beyond fraud detection, insurance analytics is playing a crucial role in personalizing insurance offerings. By analyzing customer data, including demographics, risk profiles, and past behaviors, insurers can tailor policies to meet individual needs and preferences. This leads to increased customer satisfaction and loyalty, as customers feel they are receiving a truly customized service.

Furthermore, AI and big data are streamlining critical processes such as underwriting and claims management. Analytics can automate tasks, improve accuracy, and accelerate decision-making, resulting in significant cost savings and improved operational efficiency. For example, AI-powered underwriting systems can assess risk more quickly and accurately, while automated claims processing can expedite payouts and reduce administrative overhead.

The integration of these advanced technologies is not just about improving efficiency; it's about creating a more competitive and customer-centric insurance industry. As the volume and complexity of data continue to grow, the demand for sophisticated insurance analytics solutions is expected to rise exponentially, driving the market towards the projected USD 54.47 billion valuation by 2033. The insurance companies that embrace these changes and effectively leverage data analytics will be best positioned to thrive in the future.

Insurers are recognizing the immense potential of these technologies to revolutionize various aspects of their operations. One of the primary drivers is the need for more effective fraud detection. Traditional methods often struggle to keep pace with increasingly sophisticated fraudulent activities. AI and ML algorithms can analyze vast datasets to identify patterns and anomalies that would otherwise go unnoticed, helping insurers to mitigate losses and protect their bottom line.

Beyond fraud detection, insurance analytics is playing a crucial role in personalizing insurance offerings. By analyzing customer data, including demographics, risk profiles, and past behaviors, insurers can tailor policies to meet individual needs and preferences. This leads to increased customer satisfaction and loyalty, as customers feel they are receiving a truly customized service.

Furthermore, AI and big data are streamlining critical processes such as underwriting and claims management. Analytics can automate tasks, improve accuracy, and accelerate decision-making, resulting in significant cost savings and improved operational efficiency. For example, AI-powered underwriting systems can assess risk more quickly and accurately, while automated claims processing can expedite payouts and reduce administrative overhead.

The integration of these advanced technologies is not just about improving efficiency; it's about creating a more competitive and customer-centric insurance industry. As the volume and complexity of data continue to grow, the demand for sophisticated insurance analytics solutions is expected to rise exponentially, driving the market towards the projected USD 54.47 billion valuation by 2033. The insurance companies that embrace these changes and effectively leverage data analytics will be best positioned to thrive in the future.

Category:

Technology