News

October 20, 2025

What is the difference between retirement schemes EPF and EPS?

If you are confused by personal finance terms, jargon and calculations, here’s a series to simplify and deconstruct these for you. In the 73rd part of this series, Riju Mehta explains the difference between the two retirement schemes.

Many people find the world of personal finance confusing, filled with jargon and complex calculations. To help simplify things, we're breaking down key financial concepts in an easy-to-understand series. Today, in part 73, we're tackling a common source of confusion: the difference between EPF and EPS, two prominent retirement schemes.

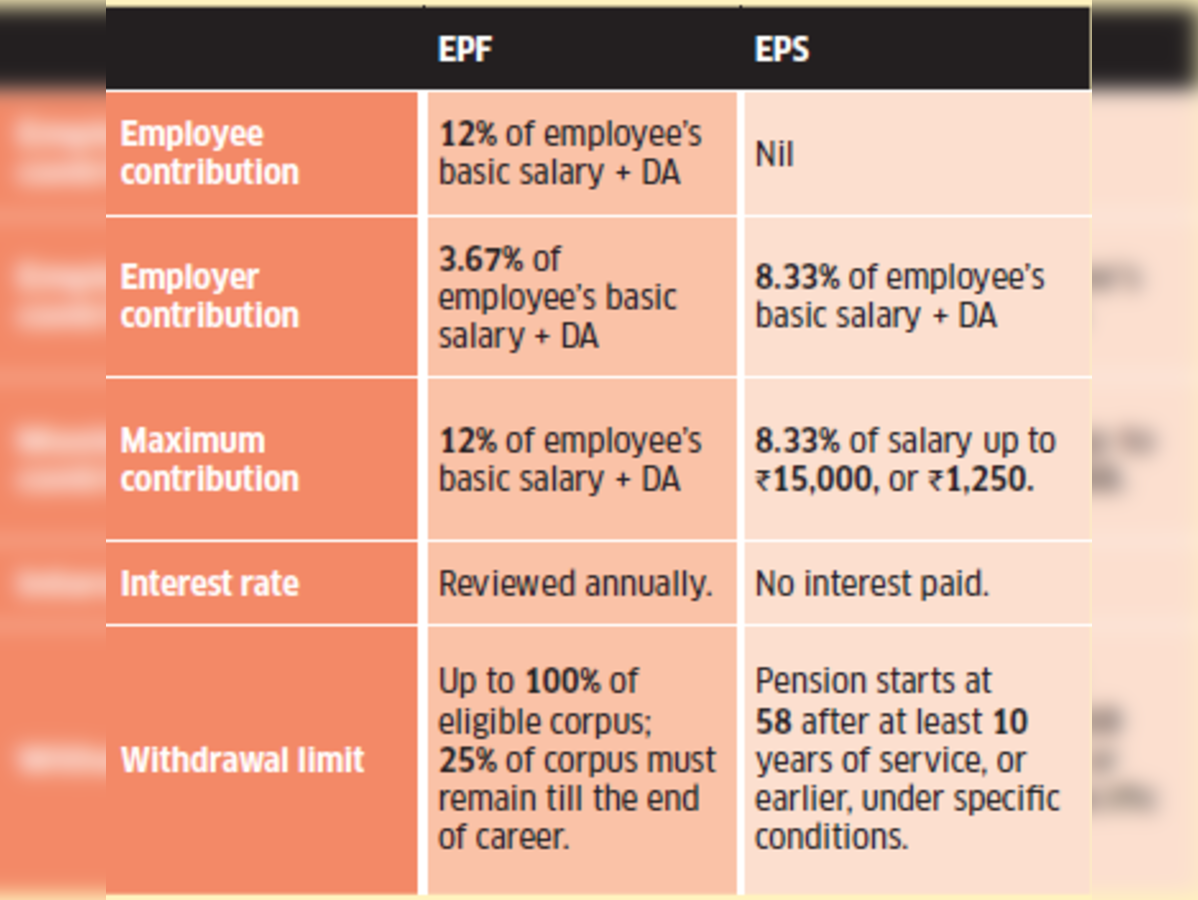

Understanding these schemes is crucial for planning your financial future. Both EPF (Employees' Provident Fund) and EPS (Employees' Pension Scheme) are integral parts of the Employees' Provident Fund Organisation (EPFO), a government-managed organization that helps salaried individuals save for retirement. However, they serve different purposes and function in distinct ways.

The EPF is essentially a savings scheme. Both the employee and the employer contribute a portion of the employee's salary (typically 12% each) to this fund. This contribution accumulates over time, earning interest. The accumulated amount, along with the interest, is available to the employee upon retirement or resignation, subject to certain conditions. It acts as a lump sum payment that can be used for various post-retirement needs.

The EPS, on the other hand, is a pension scheme. A portion of the employer's contribution to the EPF (8.33% of the employee's salary, up to a certain limit) is diverted to the EPS. This fund is used to provide a monthly pension to the employee after retirement. The pension amount is calculated based on factors like the employee's salary and years of service.

In essence, the EPF provides a lump sum retirement benefit, while the EPS provides a regular monthly income. Think of the EPF as your personal retirement savings account, and the EPS as a guaranteed monthly pension payment.

Therefore, while both EPF and EPS contribute to your retirement security, they address different aspects. The EPF provides financial flexibility and a larger sum for immediate needs, while the EPS offers a stable and predictable income stream throughout your retirement years. Understanding the difference is vital for making informed decisions about your financial planning and ensuring a comfortable retirement.

Understanding these schemes is crucial for planning your financial future. Both EPF (Employees' Provident Fund) and EPS (Employees' Pension Scheme) are integral parts of the Employees' Provident Fund Organisation (EPFO), a government-managed organization that helps salaried individuals save for retirement. However, they serve different purposes and function in distinct ways.

The EPF is essentially a savings scheme. Both the employee and the employer contribute a portion of the employee's salary (typically 12% each) to this fund. This contribution accumulates over time, earning interest. The accumulated amount, along with the interest, is available to the employee upon retirement or resignation, subject to certain conditions. It acts as a lump sum payment that can be used for various post-retirement needs.

The EPS, on the other hand, is a pension scheme. A portion of the employer's contribution to the EPF (8.33% of the employee's salary, up to a certain limit) is diverted to the EPS. This fund is used to provide a monthly pension to the employee after retirement. The pension amount is calculated based on factors like the employee's salary and years of service.

In essence, the EPF provides a lump sum retirement benefit, while the EPS provides a regular monthly income. Think of the EPF as your personal retirement savings account, and the EPS as a guaranteed monthly pension payment.

Therefore, while both EPF and EPS contribute to your retirement security, they address different aspects. The EPF provides financial flexibility and a larger sum for immediate needs, while the EPS offers a stable and predictable income stream throughout your retirement years. Understanding the difference is vital for making informed decisions about your financial planning and ensuring a comfortable retirement.

Category:

Business